International coffee prices rose sharply this week, as fears resurfaced that Brazil’s crop could get adversely affected by a drought

International coffee prices rose sharply this week, as fears resurfaced that Brazil’s crop could get adversely affected by a drought. This comes just a fortnight after Brazil’s agricultural organization Conab released its September estimate, which had assuaged market fears and even saw prices drop.

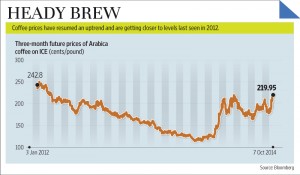

But on Monday, the three-month forward Arabica coffee contract rose by 9.2% intra-day, according to The Wall Street Journal, and closed the day with a gain of 6.9%. This marked a two-and-a-half-year high for this contract. On Tuesday, its level was unchanged. If the news on the weather from Brazil continues to support higher prices, then this uptrend could be sustained. But recent months have seen volatile price movements; so, there is risk of a reversal, too.

The International Coffee Organization’s price data show the prices of all grades of Arabica coffee have moved up, in sync with Brazil. Though Brazil’s effect is felt more by the Arabica variety, even the lower Robusta grade has perked up in October. It has recovered losses sustained in September.

A thin harvest may be bad news for Brazil but is good news for growers in other countries. Indian coffee producers are seeing firm crop trends in 2014-15. The country’s coffee crop is estimated to increase by 13.2% to 344,750 tonnes. The Arabica crop is expected to increase by 3.2%, while Robusta, which is the main local crop, is expected to rise by 18.3%.

Thus, one can expect the plantation business of growers such as Tata Coffee Ltd and CCL Products India Ltd to post good results. But this uptrend poses a challenge for coffee marketers such as Nestlé India Ltd and Hindustan Unilever Ltd (HUL). Rising input costs will force them to hike prices, which can hurt volume growth.

source: http://www.livemint.com / Live Mint / Home> Money / by Ravi Ananthanarayanan / Tuesday – October 07th, 2014