India’s output by volume tilts towards Robusta, at 70% of the estimated coffee output in 2016-17, according to Coffee Board data

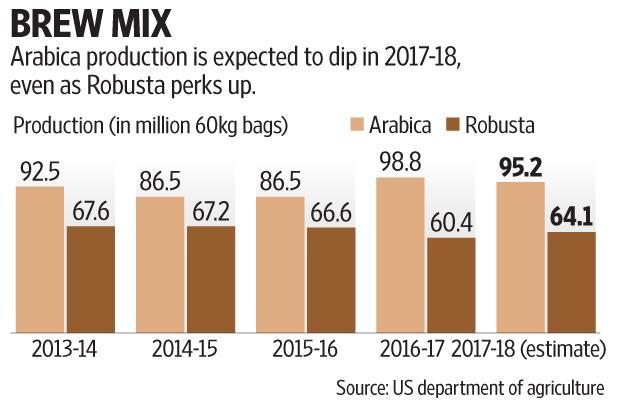

The headline forecast for coffee in 2017-18 indicates consumption is growing, while output could be flat. Coffee output is expected at 159 million bags—a bag is 60kg—the same as the previous year, according to the US department of agriculture’s (USDA’s) forecast. Domestic consumption is pegged to increase by 1.3% and along with higher exports, is expected to lower closing stocks of coffee in 2017-18. That is ordinarily a good situation for prices.

The trend looks somewhat different when you consider the two varieties, Arabica and Robusta. In 2016-17, the Arabica crop had risen by 14% but is now expected to fall by 3.6% mainly due to a decline in Brazil, which has an off year for the crop.

The Robusta variety, on the other hand, is expected to increase by 6.7%, as output in countries such as Vietnam, Brazil, Indonesia and even India is projected to increase. These countries saw output decline in 2016-17 due to bad weather conditions. Vietnam is the largest grower of Robusta and its output is expected to benefit from good rains between January and March, said the USDA report.

India’s output by volume tilts towards Robusta, at 70% of the estimated coffee output in 2016-17, according to Coffee Board data. Although output fell that year, prices of Robusta had risen sharply. The Robusta benchmark of the International Coffee Organization on 15 June was up by 24% over a year ago, but the Brazilian Arabica benchmark was down by 10.6%. Recent months have seen Robusta prices turn flattish-to-lower.

Predictions of a better monsoon in 2017-18 are expected to see India’s coffee output recover after falling by 9.8%, based on post-monsoon estimates. That is good news even if prices stay flat but not if prices decline as that can affect margins. However, lower prices should benefit instant coffee makers such as Hindustan Unilever Ltd and Nestlé India Ltd, as also the instant coffee operations of companies such as Tata Coffee Ltd, which also runs coffee plantations.

The one imponderable here is that the goods and services tax on instant coffee has been set at 28% compared to 5% on other coffee (such as roast and ground). This can be a dampener for the instant coffee business and one will have to see if companies hike prices post-1 July. That can potentially upset demand.

source: http://www.livemint.com / Live Mint / Home> Money / by Ravi Ananthanarayanan / Tuesday – June 20th, 2017